Buying real estate on your own was once almost unheard of. Couples and families would buy property when starting a new phase of their lives, but single people largely stayed out of the property market. But this is no longer the case today, with solo homebuyers making up a larger and larger portion of those buying property in Malta.

The advantages of homeownership are just as clear for single people as for everyone else, from the investment potential to the increased freedom to tailor your space to your tastes and lifestyle. At the same time, however, going it alone could mean facing challenges that those going through the process with a partner might not, or at least not to the same degree.

So, if you’re thinking of taking the plunge by yourself, here are our top tips for keeping the process as smooth as possible.

Figure out your finances

One of the biggest obstacles solo home buyers buying property in Malta should be prepared to encounter is their budget. The size of the home loan you’re able to qualify for is based on your income – when buying Malta real estate with a partner, that often means two incomes and a larger loan, while going it alone naturally means your buying power is likely to be more limited.

Putting aside enough money to save up for the deposit could similarly be more challenging on a single income. It’s also important to factor in the additional costs involved in the buying process, which include bank charges, architects’ and notaries’ fees, permits and finishing costs.

None of this means you should be giving up on your dream, just that you need to plan more carefully. Visit your bank early to understand what sort of property you can afford. Shop around a bit to find the best loan rates and conditions that work for you. Create a savings plan with how much you need to put aside and how long it will take you to reach that goal.

Government Incentives

Look into initiatives like the government’s first-time buyers’ scheme and grant for restoration of properties in Urban Conservation Areas (UCAs) that could provide extra help.

Remember to protect yourself! Being a solo homeowner means having to be a bit more self-reliant, so make sure your financial situation is stable and that you have a few months’ worth of salary set aside as a contingency fund in case of job loss, illness, or urgent repairs.

Have a good sense of your needs and wants

No two people are alike, so no single property is going to be perfect for everyone. But one advantage of buying a Malta Property solo is that there’s no need to find common ground between different sets of preferences: it’s just you! On the other hand, you may still find yourself needing to make compromises for the sake of your budget, so think carefully about your lifestyle, wants and needs to help you land on the ideal property.

Location

Do you prefer to be in the centre of a bustling commercial area, with easy access to shops, cafes, bars and entertainment? Or would you prefer something in a quieter neighbourhood? Do you need to be close to work or are you prepared for a bit of a commute? What are your priorities and what are you more willing to compromise on?

Property Size

Think about the size of home you’d be most comfortable living in: if you’re living on your own, you may find an apartment is more manageable when it comes to maintenance and keeping it clean. But if you’re planning to do a lot of entertaining, you may benefit from the added space or outdoor areas a house could provide.

If your budget allows, don’t feel limited to a one-bedroom property. Many solo homebuyers like to have a second bedroom they can convert into an office (particularly with the rise of work-from-home arrangements), keep as a guest room, or even rent out for additional income to help with the loan repayments. Learn more about 7 things to look out for when buying a family home.

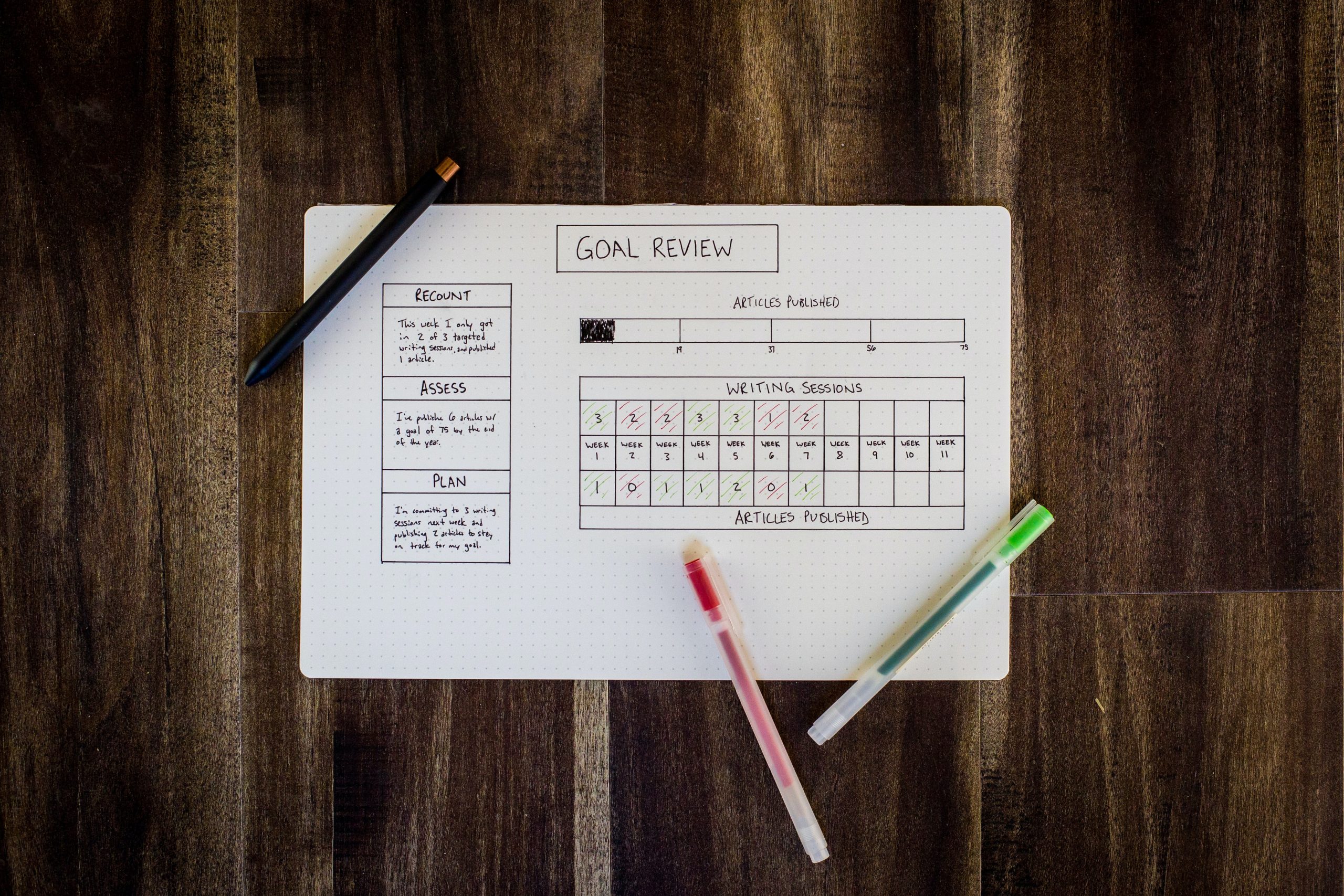

Take a long-term view

Buying and owning property in Malta is a fantastic way to achieve stability, but a home is not just an investment: it’s a place you’re actually going to be living in, possibly for a very long time.

Costs of ownership

Factor in the costs of ownership when working on your finances and consider how prepared you are to handle the many issues that are likely to crop up. This is particularly important if you’re looking at a house of character or other older properties that need more maintenance. Are you able to handle repairs and upkeep, or to pay for them if not?

Future Goals

Think about how your future goals may be different to your present circumstances. Of course, you needn’t be planning to spend the rest of your life in the home you’re buying now, but a home that starts to feel limiting after just a short period of time is never going to be ideal.

On the flipside, give some thought to the things that could go wrong over a longer timeframe, such as a downturn in your personal finances or in the housing market. It may not be likely to happen but knowing you could cope if it did will provide some valuable peace of mind.

Thinking long-term also means reminding yourself about your end goal if the stresses of homebuying ever threaten to get too much. There’s a reason you’re doing this – whether it’s about the investment, stability, or wanting more freedom with your own space – and keeping that in sight can help you remain sane through what can sometimes be a long or difficult process. It will be worth it in the end! Read more about top 10 reasons to get on the Malta property ladder now.

Know what to expect

The Malta property buying process can sometimes be a complicated one. Apart from working out your finances, researching as much as you can about what to expect ahead of time will help you once you’re in the thick of things. A good real estate agent will help you focus your search and find the right property but putting in an offer isn’t quite the end of the journey.

Once you and the seller have agreed on a price, you’ll sign a promise of sale agreement, known as a konvenju, which binds both parties to the sale and sets a timeframe for it to be completed, subject to certain agreed conditions. At this stage you’ll usually pay 1% in provisional stamp duty (out of the total 5% due) and 10% as a deposit.

Before the agreed-upon date for completion, your notary will carry out Public Registry and Land Registry searches, while you will have to secure your bank loan and anything else required by the konvenju. Once all this is done, you’ll meet to sign the final deed, settling the final balance, remaining stamp duty and notary’s fees.

Even then, there are still some remaining requirements for your notary to fulfill, and there may be some outstanding issues such as planning irregularities to be dealt with. Going through it all as a solo homebuyer can feel like a lot, which makes it all the more important that you…

Don’t go it (entirely) alone

Just because you’re committed to buying a house on your own, it doesn’t mean you should try and go through the entire process alone. Buying a house in Malta is exciting but it can also be a daunting experience even at the best of times, particularly if it’s your first time, and not having anyone to lean on can make it completely overwhelming.

Do your research beforehand and seek out experiences of other people who have bought their houses solo, whether among your friends and family or online. When viewing houses, take a friend or family member with you: if they’re more experienced, they may be able to ask questions or spot issues you’re not aware of, and even if not, having a second pair of eyes and someone to share thoughts with will help ease the mental load, and could become part of the fun.

Make sure you surround yourself with the right experts, including your notary, architect and, of course, real estate agent. From the moment you start looking, the right real estate agent can help narrow down your search to the perfect properties that fit your finances, needs and wants, set up viewings and make sure you get the most out of them, help you put in the right offer and guide you through the purchasing process. Learn more about 7 things to look out for when buying a family home.

Why choose JK Properties

At JK Properties, we have the largest database of property in the country and expert real estate associates trained to help make your search as stress-free as it can be. Get started today!

Newsletter Sign Up

Sign Up For Our

Newsletter

Join JK Properties newsletter and be updated with the latest properties for sale in Malta.